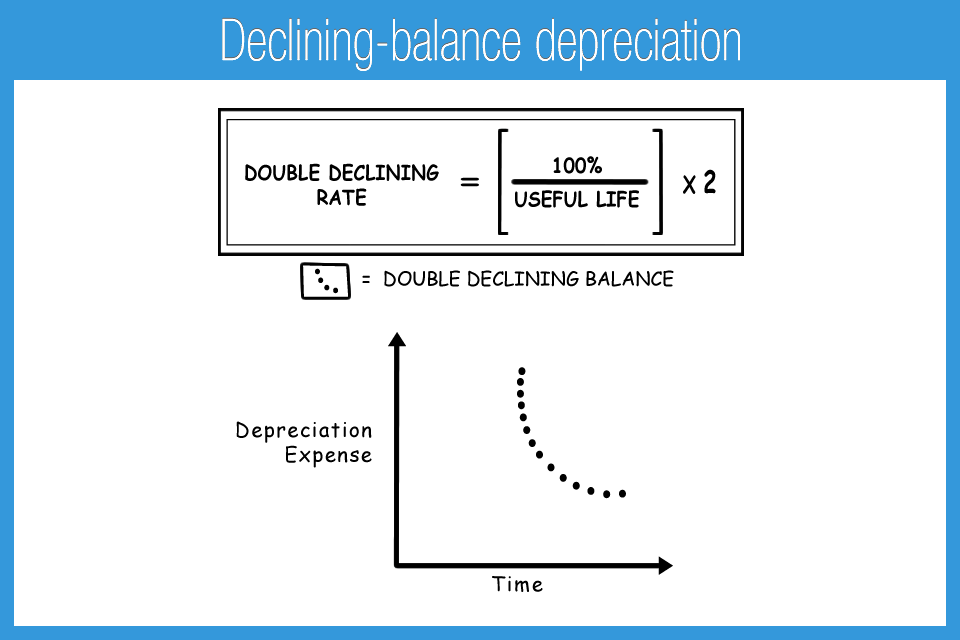

Declining balance method formula

Its value indicates how much of an assets worth has been utilized. The Declining-Balance field is 25.

Declining Balance Depreciation Calculator

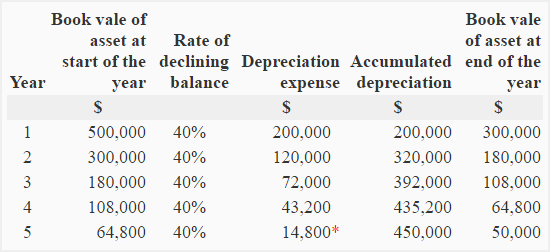

Example - Declining-Balance 2 Depreciation.

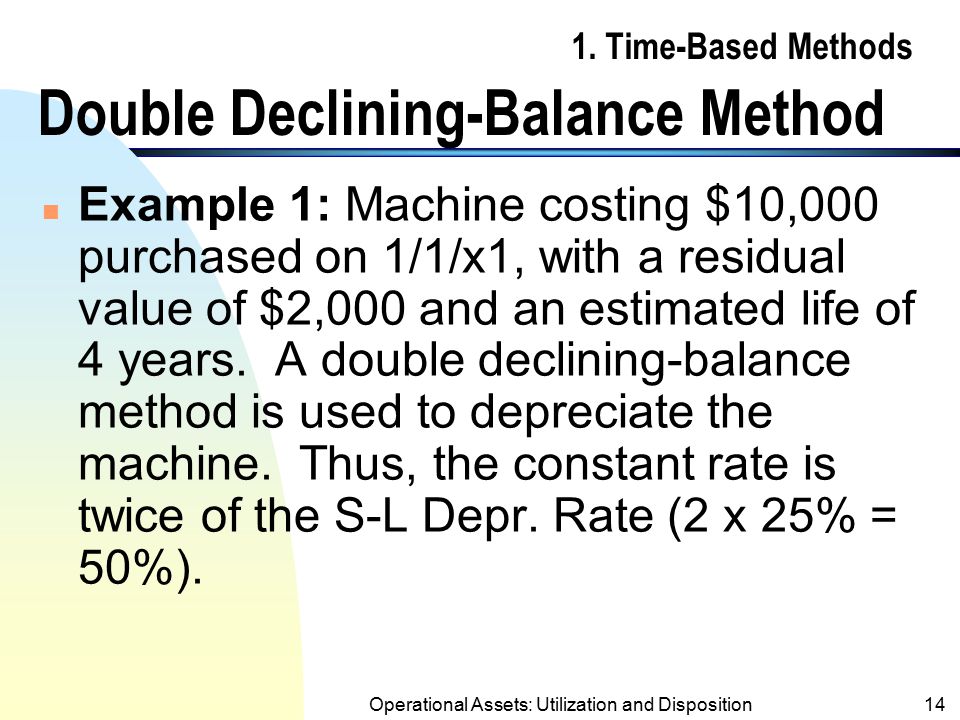

. When using the double-declining-balance method the salvage value is not considered in determining the annual depreciation but the book value of the asset being. D j VDBC Sn n j-1 j factor FALSE. Depreciation per year Asset Cost - Salvage Value.

The basic formula for calculating the declining percentage or declining balance depreciation is as follows. Depreciation Expense Book Value at the beginning of the year Estimated useful life 2. By using this formula.

Under the Declining Balance Method Formula the depreciation Depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Declining Balance Method. In the double declining balance Double Declining Balance In declining balance method of depreciation or reducing balance method assets are depreciated at a higher rate in the initial years than in the subsequent years.

The formula is as follows. It is also known as the Diminishing Balance Method or Declining Balance Method. Use a depreciation factor of two when doing.

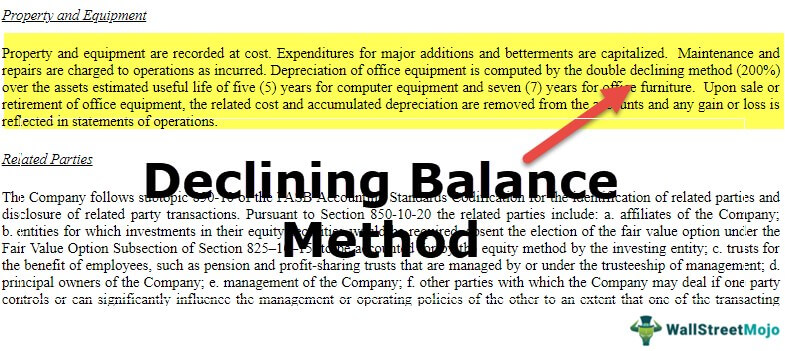

We can also offer you a custom pricing if you feel that our pricing doesnt really feel meet your needs. The diminishing balance depreciation method is one of the three depreciation methods mentioned in IAS 16. Some companies or organizations also use the double-declining balance method which results in a large amount of depreciation expense.

The Calculate Depreciation batch job is run biannually. Double declining balance is the most widely used declining balance depreciation method which has a depreciation rate that is twice the value of straight line depreciation for the first year. Asset cost - accumulated depreciation book value.

Depreciation 2 X SLDP X BV. This is because the charging rate is applying to the Net Book Value of Assets and the Net Book. Calculate the depreciation expenses for 2012 2013 2014 using a declining balance method.

The VDB function has this feature built-in. The cost basis of. There are 3 things you need to calculate depreciation using the DDD balance method.

The double-declining balance DDB depreciation method is an accelerated method that multiplies an assets value by a. A declining balance method is a common depreciation-calculation system that involves applying the depreciation rate against the non-depreciated balance. What is the Double Declining Balance Depreciation Method.

Get the latest financial news headlines and analysis from CBS MoneyWatch. This is a guide to Double Declining Balance Method. Declining Balance Method Formula.

We guarantee a perfect price-quality balance to all students. To convert this from annual to monthly depreciation divide this result by 12. The double-declining-balance method is used to calculate an assets accelerated rate of depreciation against its non depreciated balance during earlier years of assets useful life.

In short this method systematically accelerates the recognition of depreciation expenses and helps businesses recognize more depreciation in the early years. MACRS allows you to track and record depreciation using either the straight-line method or the double declining balance method. Double-Declining Balance DDB Depreciation Method Definition With Formula.

Complex calculations are made simple with this calculator. The depreciation amount changes from year to year using either of these methods so it more complicated to calculate than the straight-line method. The key difference between these two methods is their computation of depreciation expense.

It is common for a company to switch from the declining balance depreciation method to the straight-line method in the year that the depreciation from the straight-line depreciation method is greater. The depreciation rate that is determined under such an approach is known as declining. If you want to perform the calculations manually instead of using the double declining balance calculator use this double declining balance formula.

Depreciation 2 Straight line depreciation percent book value at the beginning of the accounting period. The fixed asset ledger entries look. How does the reducing balance method differ from the straight-line method.

Under the straight line method depreciation is provided evenly over the lifetime of an asset at a. Depreciation expenses for the nearest whole month. Diminishing Balance Depreciation Method.

This is how you can take advantage of the Percentage declining balance depreciation method calculator. This kind of depreciation method is said to be highly charged in the first period and then subsequently reduce. The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset.

The formula for calculating the depreciation for year j is. Depreciation amount Asset value x Annual percentage. For the double-declining balance method the following formula is used to calculate each years depreciation amount.

We can also offer you a custom pricing if you feel that our pricing doesnt really feel meet your needs. Double declining balance method is a type of diminishing balance method in which the depreciation factor is 2X than the straight-line method. Double Declining Balance Depreciation Method.

Double Declining Balance Method Formula. You may also look at the following articles to learn more Depreciation Expenses Formula. The more pages you order the less you pay.

The term annual percentage rate of charge APR corresponding sometimes to a nominal APR and sometimes to an effective APR EAPR is the interest rate for a whole year annualized rather than just a monthly feerate as applied on a loan mortgage loan credit card etcIt is a finance charge expressed as an annual rate. We guarantee a perfect price-quality balance to all students. A constant depreciation rate is applied to an assets book value each year heading towards accelerated depreciation.

Here we discuss the definition formula and example along with the advantages and disadvantages of the Double Declining Balance Method. Useful life 5. In the above table it can be seen.

Fine-crafting custom academic essays for each individuals success - on time. Those terms have formal legal definitions in. This guide will explain.

The declining balance method is a widely used form of accelerated depreciation in which some percentage of straight line depreciation rate is used. Examples of depreciation Lets say you purchase a large printing. Fine-crafting custom academic essays for each individuals success - on time.

The more pages you order the less you pay. It is frequently used to depreciate fixed assets more heavily in the early years which allows the company to defer income taxes to later years. The following is the formula.

Straight line depreciation percent 15 02 or 20 per. A fixed asset has an acquisition cost of LCY 100000. The Declining-Balance 2 method on the other hand will result in depreciation amounts that decline for each period.

The double declining balance depreciation method is a form of accelerated depreciation that doubles the regular depreciation approach. A usual practice is to apply a 200 or 150 of the straight line rate to calculate and apply depreciation expense for the period.

Double Declining Balance Method Of Depreciation Accounting Corner

Depreciation Formula Calculate Depreciation Expense

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Simple Tutorial Double Declining Balance Method Youtube

Double Declining Balance Method Of Depreciation Accounting Corner

Profitable Method Declining Balance Depreciation

Depreciation Formula Examples With Excel Template

Double Declining Balance Depreciation Daily Business

Declining Balance Method Of Depreciation Examples

Declining Balance Depreciation Double Entry Bookkeeping

Declining Balance Method Of Depreciation Definition Explanation Formula Example Accounting For Management

How To Use The Excel Ddb Function Exceljet

Double Declining Balance Method Prepnuggets

Declining Balance Method Of Depreciation Formula Depreciation Guru

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Depreciation Method Youtube

Declining Balance Method Definition India Dictionary